Common Challenges Faced by HR Teams

Common Logistics Challenges That Slow You Down

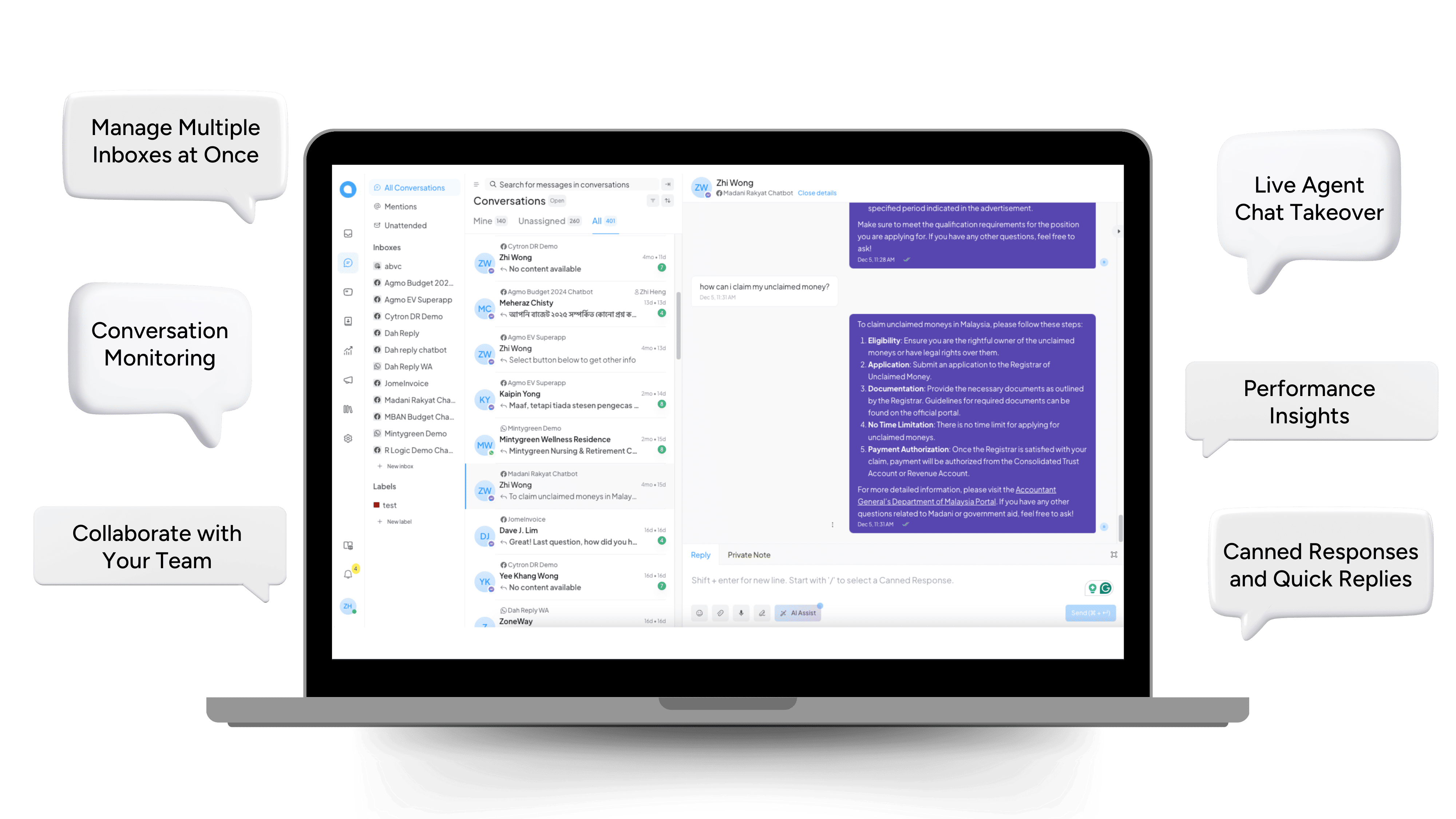

Logistics teams juggle a constant flow of updates, enquiries, and coordination — but most of it is still done manually. That means slower replies, delayed deliveries, and frustrated partners. DahReply automates the routine so your team can focus on moving things forward.